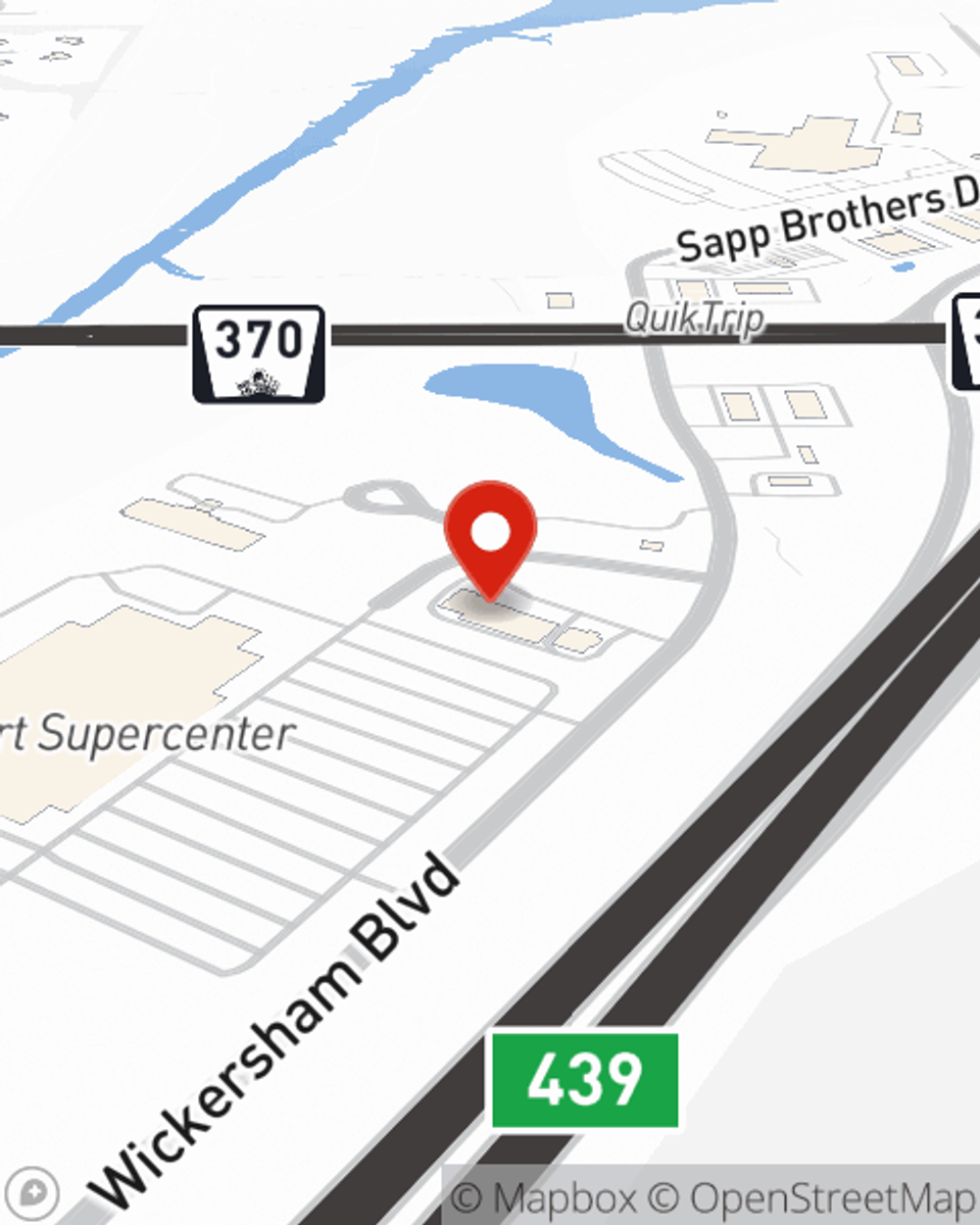

Business Insurance in and around Gretna

Looking for small business insurance coverage?

This small business insurance is not risky

Business Insurance At A Great Price!

Operating your small business takes time, effort, and outstanding insurance. That's why State Farm offers coverage options like worker's compensation for your employees, business continuity plans, a surety or fidelity bond, and more!

Looking for small business insurance coverage?

This small business insurance is not risky

Customizable Coverage For Your Business

Whether you own cosmetic store, a pizza parlor or a veterinarian, State Farm is here to help. Aside from remarkable service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Call or email agent Derek Bird to review your small business coverage options today.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Derek Bird

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.